Correction of VAT returns via TFA

On 21 September 2023, the Cyprus Tax Department announced that taxpayers may correct their VAT returns via the Tax For All (TFA) online platform.

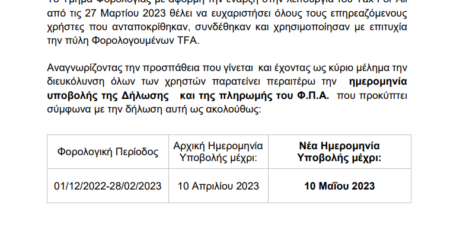

Corrections to the VAT returns can be made as follows:

- Until the deadline for ANY boxes of the VAT return (i.e. Box 1 to 11B)

- After the deadline ONLY for boxes of the VAT return that are not related to the output/input VAT (i.e. Box 6 to 11B)

This ability to correct VAT returns concerns only the VAT returns submitted via TFA with submission date after the 27th of March 2023.

Corrections to VAT returns that have been submitted and their deadline date was prior to the 27th of March 2023, can be submitted to the Tax Department via TFA under the applicable rules for correction.

Link to published announcement.

ACUTE ADVISORY SERVICES TEAM