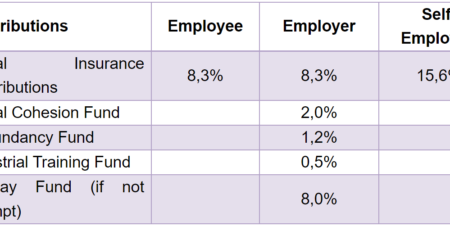

Social Insurance Contribution Rates

As of 1st January 2024, the Social Insurance Contribution rates for each of the employer and the employee are increased by 0.5% and for self-employed individuals by 1%.

The below table summarizes the contribution rates which are applicable for the tax year 2024:

| % | |

| Self-employed individuals | 16,6 |

| Employee’s contribution | 8,8 |

| Employer’s contribution | 8,8 |

| Employer’s contribution to the Redundancy Fund | 1,2 |

| Employer’s contribution to the Human Resource Development Authority Fund | 0,5 |

| Employer’s contribution to the Social Cohesion Fund | 2 |

Social Cohesion Fund

An employer is liable to pay a social cohesion fund contribution of 2% on the amount of the emoluments of his employees (without any restriction as to the amount of the emoluments).

Maximum limit of emoluments

As of the beginning of 2024 the below maximum amount of emoluments are applicable for Social Insurance Contribution purposes:

| € | € | € | |

| Weekly employees | 1.209 | 64.077 | |

| Monthly employees | 5.239 | 62.868 |

ACUTE ADVISORY SERVICES TEAM