SOCIAL INSURANCE CONTRIBUTIONS 2026

For this year the maximum insurable amount applicable for social insurance contribution purposes has been increased to €68.904 per annum.

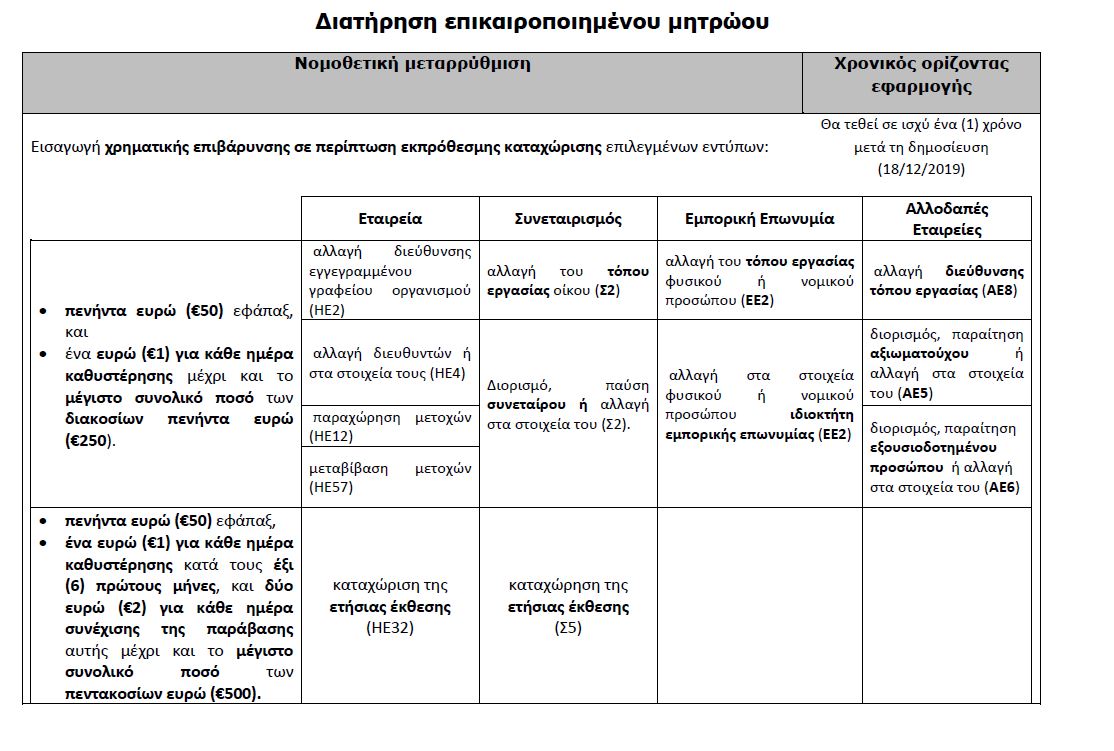

The Social Insurance Contributions for 2026 are summarized below:

| Contributions | Employee | Employer | Self-Employed |

| Social Insurance Contributions | 8,8% | 8,8% | 16,6% |

| Social Cohesion Fund | 2,0% | ||

| Redundancy Fund | 1,2% | ||

| Industrial Training Fund | 0,5% | ||

| Holiday Fund (if not exempt) | 8,0% |

Note 1: The Social Cohesion Fund is calculated on total emoluments and has no maximum level.

Note 2: As from 1 January 2026, the maximum amount applicable for social insurance contribution purposes has increased to €68.904 p.a. from €66.612 p.a., to €5.742 from €5.551 per month for monthly paid employees and to €1.325 from €1.281 per week for weekly paid employees.

Remaining at your disposal should you have any questions.

Acute Advisory Services team