Tax Alert

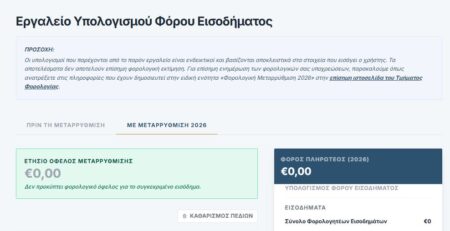

The Tax Department has announced that, as of June 1st 2018, the following taxes, not bearing interest and charges, can ONLY be paid via JCCsmart.

|

Tax code |

Description |

| 0114 | Reduction in Salaries and Wages of the Broader Public Sector |

| 0200 | Temporary Income Tax for Individuals and Companies |

| 0300 | Self-Assessment of Income Tax for Individuals and Companies |

| 0300 | Income Tax (without charges) |

| 0602 | Special Contribution for Defence withheld from Interest at source |

| 0604 | Special Contribution for Defence on Rental Income |

| 0612 | Special Contribution for Defence on Interest Income without deduction at source |

| 0603 | Special Contribution for Defence withheld from Dividends at source |

| 0613 | Special Contribution for Defence on Dividends without deduction at source |

| 0614 | Special Contribution for Defence withheld from Rents at source |

| 0623 | Special Contribution for Defence withheld on Deemed Dividend |

When the above taxes bear interest and charges or relate to payment of Revised Temporary Tax of Individuals or Companies (tax code ‘200’), the payments can ONLY be made at the District Collection Offices.

Taxes arising out of tax assessments or self-assessments, can be paid by completing the relevant fields of the corresponding taxes, as presented on the website www.jccsmart.com.cy.

It is noted that as of March 1st 2018, the monthly payments of tax withheld from employees emoluments (P.A.Y.E.) can only be made via JCCsmart.